Third-party platforms are modernizing how brokers quote voluntary and ancillary benefits, providing an intuitive digital experience to instantly quote and select multiple carriers and lines of coverage.

Sounds amazing, right? Some carriers have embraced this transformation, partnering with tech platforms to ensure their products are distributed to brokers via today’s growing digital ecosystem. But for others, there’s been hesitancy to adopt a 3rd-party strategy.

What factors are leading to these varied outlooks and strategies?

Ideon, an API company that connects carriers and platforms in an easy and scalable way, recently hosted a webinar where a panel of experts explored the evolution of ancillary benefits quoting, the value of 3rd-party partnerships, the digital demands of today’s brokers, and more.

In this blog, we highlight five key takeaways from the event, which featured:

– Jeremy McLendon — Sr. Vice President at MyHealthily

– Hannah Thompson — Sr. Manager of Solution Architecture at Beam Benefits

– Eric Weiford –– Sr. Relationship Manager at Principal Financial Group

A full recording of the webinar is available for download, here.

1. The fear of spreadsheeting is overblown.

One prevalent reluctance among carriers, as they consider offering their products through 3rd-party platforms: Won’t this just lead to my plans being spreadsheeted?

All three panelists agreed — spreadsheeting is happening regardless, and carriers may as well empower it through distribution and great digital experiences.

“Distribution means some change in tradition,” McLendon said. “You’re probably going to be spreadsheeted as it is. So why not win and do it a little faster?”

Beam approaches spreadsheeting from a similar perspective, Thompson said. “Cool, put us on the spreadsheet, especially if that broker is getting a quote through a digital platform where we’re API-connected. Spreadsheeting is unavailable, but the shift over to API quoting is making it a lot more advantageous to carriers like Beam.”

“If brokers and general agents aren’t doing that, they are going to lose that business at some point anyway,” Weiford added. “From a broker’s due diligence, they have to spreadsheet every now and then.”

2. API-powered, fully-underwritten quoting is the new frontier.

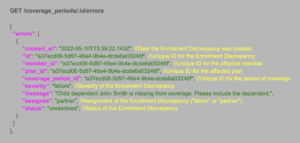

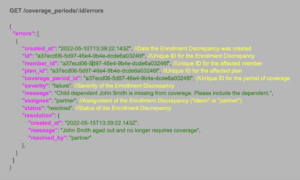

APIs allow carriers and platforms to communicate and exchange information in real time. The technology is becoming favored for a range of benefits-related tasks, including enrollment, EOI decisions, claims, and more.

Recently, APIs have made their way to the ancillary quoting space, allowing users of platforms like MyHealthily to generate instant, underwritten quotes based on group-specific criteria. The platform submits group information via a carrier API, and the carrier’s algorithm spits out underwritten quotes, all within seconds.

“We have prioritized platforms that can connect to our APIs,” Thompson said. “Through API quoting integrations, we can ingest census data, which means we can provide custom, underwritten, real-time bindable rates to these platforms.”

3. There’s untapped potential in the small group market.

Digital quoting solutions were historically available only in the large group space, but according to Thompson, that’s beginning to change.

“That ability to deliver real-time, custom, underwritten rates through an API connection—or even via Beam’s own tools for small groups—it’s huge, it’s an underserved market,” Thompson said. “The ability to provide really sharp rates to small groups, in a way that the large group space has benefited from in the past, is a unique opportunity for our industry.”

Like Beam, Principal has designed its digital strategy to win business down market and bring modern technology to small businesses.

“Our bread and butter is in the small group space,” Weiford said. “We’re constantly having conversations with the intermediaries who are adopting these platforms, looking at what is and isn’t working, so we can be agile in trying to make things work for them and for Principal.”

4. Getting started requires gaining organizational alignment.

Custom underwriting is seen by many carrier reps as a differentiator. So, internally, how do carrier executives get buy-in and explain the value of 3rd-party quoting?

“Distribution via 3rd-party platforms is only going to get more eyeballs to your products,” Thompson said. “And that hopefully means more RFP conversions for your team. The way we position it internally, is if a broker is going to go through a platform, we will still associate a rep to those opportunities. Oftentimes, there’s still consultation that needs to happen, from the rep to the broker, to ensure the broker is positioning the product appropriately. We still plug our reps into that flow.”

Carriers, Weiford explained, can alleviate concerns among their reps by including them in conversations about third-party quoting, explaining that it will lead to more opportunities, and showing them detailed reporting. But, it might take time for total organizational buy-in.

“Adoption isn’t always there at first,” Weiford said. “When reps start seeing that they can get additional swings, then it starts getting a little bit more palpable. And then you start showing them reports, ‘hey, here’s 100 new opportunities, go win that business by working with the broker.’ Platforms are not the enemy—you’re working alongside them.”

5. The right strategy and partnerships can mitigate scalability concerns.

For third-party platforms that have ancillary quoting functionality, scaling up can be challenging. Platforms want to offer brokers lots of carriers and products, but doing so requires partnership discussions, relationship management, and technical integrations.

“We tend to be carrier-agnostic, as we want to offer a large marketplace to our brokers,” McLendon said. “But constantly vetting and integrating with carriers can take time away from our development team. We look for the carriers that are willing to adopt early — from our experience, those are the opportunities where we can grow together.”

Ideon, McLendon explained, has helped MyHealthily solve the scalability problem.

“Working with partners like Ideon, a middleware so to speak, is nice because it allows us to integrate with more carriers more quickly. That way we can take on other projects.”

For carriers, the value of working with Ideon is similar. It enables them to integrate with numerous downstream quoting platforms without building direct integrations to each system.

To watch the full webinar recording, click here. To learn more about how Ideon helps carriers and platforms grow in the ancillary quoting space, contact us and we’ll be in touch.