**NOTE: Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

2022 ACA health plan data shows that in nearly half of U.S. states, an ICHRA could be a cost effective solution for small employers seeking to give employees more plan options

December 16, 2021 – Vericred, the API platform powering digital quote-to-card experiences in health insurance and benefits, today announced it has released its annual map of states where insurance premiums are most friendly to Individual Coverage Health Reimbursement Arrangements (ICHRAs). Employers who choose to offer an ICHRA provide a monthly, tax-free stipend that employees put toward the premium of a plan they choose from the individual market.

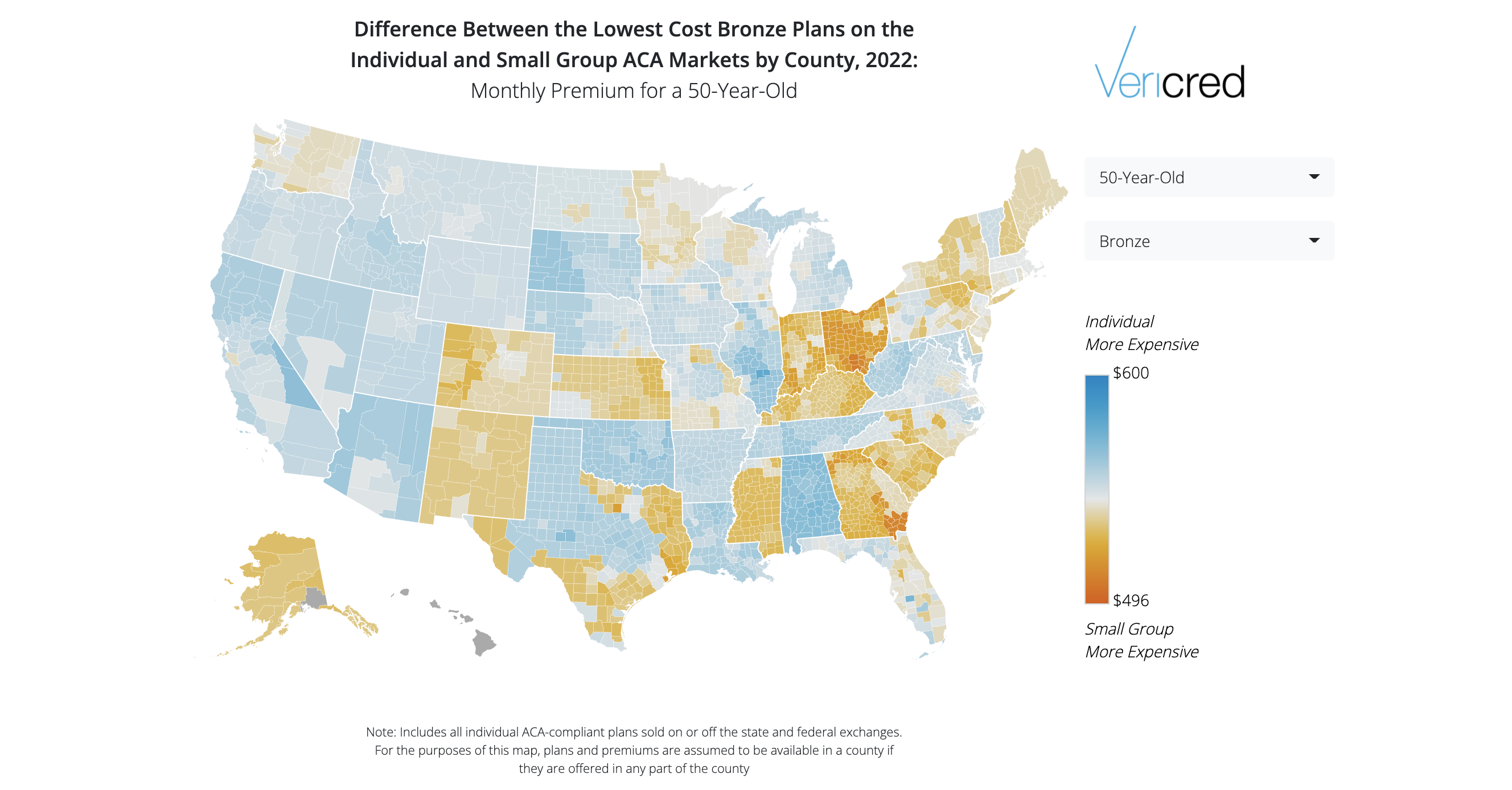

The Vericred 2022 ICHRA Map shows the counties and states where an employee using an ICHRA would likely find Affordable Care Act (ACA) individual premiums equal to, or less expensive than, ACA small group plan premiums, i.e., “ICHRA-friendly.” For each state, Vericred calculated the difference between the average (across all counties) lowest-cost Bronze plan in the ACA small group and individual markets.

Key findings from the Vericred 2022 ICHRA Map include:

- Nearly half of the U.S. is ICHRA-friendly — in 24 states, 2022 individual Bronze plan premiums are equal to or less expensive than small group plan premiums

- The number of ICHRA-friendly states grew by 26% since 2021, when 19 states were considered ICHRA-friendly. In 2020, only 16 states were ICHRA-friendly

- The top five ICHRA-friendly states, are, in order, Ohio, Georgia, Indiana, South Carolina and Mississippi

- The five least ICHRA-friendly states, which have a market where premiums in the ACA individual market are most expensive compared with the ACA small group market, are, in order, Alabama, Oklahoma, Illinois, Tennessee and West Virginia

- Some states have flipped – Maryland was ICHRA-friendly last year, and is now not ICHRA-friendly. In 2021, Kansas was among the least ICHRA-friendly states; now it is no longer

“Historically, individual market premiums have been more expensive than small group premiums. Our data shows this is changing, and fast. ICHRA is now an attractive, cost-effective option for employers seeking to offer employees health insurance for the first time, or for those offering coverage, to control their benefit costs,” said Michael W. Levin, CEO and co-founder of Vericred. “We expect this trend to continue in the coming year, and as a result, we anticipate that more employers will offer ICHRAs.”

Resources

About Vericred

Vericred is the way health insurance carriers and employee benefits providers connect with new technology partners to deliver seamless quote-to-card consumer experiences. We are not the websites or apps you use to choose a plan or find a doctor. We are the infrastructure. We are the ‘pipes’ that simplify the complex exchange of quoting, enrollment and eligibility data between carriers and the technology partners responsible for delivering health and employee benefits to hundreds of millions of Americans everyday. Our APIs transmit billions of data points between InsurTech and insurance carriers, powering digital distribution across the insurance industry. Visit www.vericred.com.