**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

Sabre ignited innovation and transparency throughout the travel industry. Decades later, a similar business model is transforming health insurance and employee benefits

At Vericred, we’re committed to simplifying the exchange of data between health insurance and employee benefits carriers and tech companies, fostering a new era of transparency, innovation and efficiency for stakeholders throughout the health and benefits ecosystem. Accomplishing this ambitious mission is transforming how consumers, businesses, employees and brokers quote, enroll in and manage health and benefits coverage.

A similar, previous monumental shift altered an equally complex ecosystem and created a blueprint for digital vanguards like Vericred: Sabre sparked consumerization, innovation and digital efficiency throughout the travel industry. But to fully comprehend why Sabre’s business model is adaptable beyond the travel industry, it’s vital to understand the company’s 60-year evolution from inventor of a game-changing, tangible product to leaders of a digital-first platform business.

Sabre: Powering the travel industry toward consumerization

During the inaugural phase of mass passenger air travel in the late-1950s, consumers and travel agents booked flights in person at airports, ticket offices and over the phone. This inefficient, labor-intensive process was both inconvenient for passengers and susceptible to human-induced booking errors. But where there’s a problem, there’s generally an innovative, tech-powered solution waiting around the corner.

Enter, Sabre. In 1964 the company launched its airline reservation terminal: the first fully operational, automated flight inventory and booking system. The Sabre Terminal fundamentally altered the booking experience for passengers and agents, enabling them to easily quote, compare and purchase flights, while improving operational efficiency and reservation accuracy for the airlines.

Fast forward to today, and Sabre has only strengthened its position within the airline, hotel and travel industries by shifting its business model from product-focused to platform-based. Once a producer of a physical product, the Sabre Terminal, Sabre now offers the underlying infrastructure serving online travel agencies, search engines, corporations and app developers around the world. Connecting and facilitating interactions throughout this intricate web of stakeholders enables what travelers now take for granted: their ability to easily reserve hotels, flights, cars, vacations, cruises and other travel, all via simple-to-use, secure platforms.

A blueprint for digital changemakers

Sabre’s success story as a transformative intermediary between travel entities and consumers offers other digital innovators a framework for transforming their own similarly complex industries.

The key to Sabre’s decades-long success was its transition to a platform business model. Platform businesses drive value to various groups of stakeholders by facilitating exchanges — of currency, information, data, etc.— between two or more participants.

Multi-sided, scalable platforms generate greater value for its users as more participants join the platform. Therefore as more airlines and hotels partnered with Sabre, its services proved more valuable to agents, app developers and booking platforms. Conversely, as more agents, developers and platforms leveraged Sabre’s services, airlines and hotels gained additional revenue opportunities and greater efficiency in how they distribute data to downstream end users. This skillful, deliberate value generation for all of its stakeholders is what enabled Sabre to become the undisputed king of a market category of its own creation: the leading travel industry data solutions provider, entrenched as a business necessity for airlines, hotels, agents and tech companies alike.

So what have other businesses, and industries, learned from Sabre’s blueprint?

In the finance and banking industry, global payments leader Visa recently acquired fintech startup Plaid for a whopping $5.3 billion. Often described as the digital “plumbing” linking the modern financial services sector, Plaid connects consumers, app developers and banking institutions through behind-the-scenes APIs.

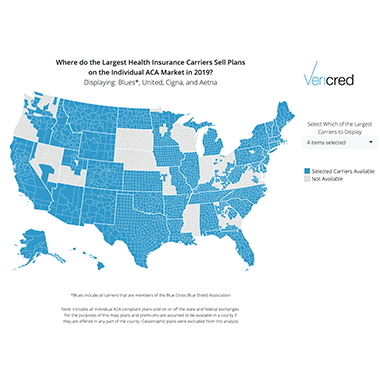

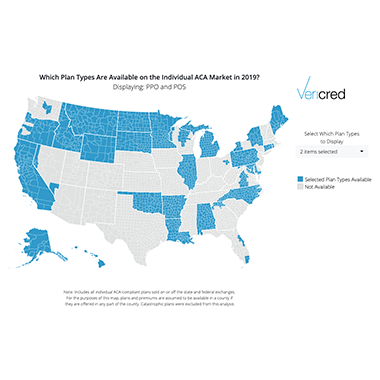

Just as Plaid’s and Sabre’s digital infrastructure enables innovation in the financial and travel industries, Vericred is building from the ground up APIs and data solutions that are igniting a similar digital transformation throughout the health and benefits ecosystem. Like the aforementioned companies, Vericred’s multi-sided platform empowers tech companies to develop innovative digital products and services ushering in a new era of efficiency and transparency. Whereas Sabre connects travel-related stakeholders — airlines, hotels, agents, consumers, booking platforms, app developers, car rental firms, etc. — Vericred binds together essential constituents of the health insurance and employee benefits space: insurance carriers, brokers, online insurance marketplaces, Benefits Administration and HR Solutions, consumers, businesses and employees.

By linking these essential constituents, Vericred is knocking down data and connectivity walls, enabling digital innovation to reach all corners of the health and benefits landscape.

We believe the future of health insurance is digital, frictionless, transparent and user-friendly. Just as travel and banking rely on foundational APIs to connect their ecosystems, we envision a future in which the digital distribution of health insurance and benefits will materialize with Vericred paving the way.