Ideon Blog

September 19, 2019

By: Ideon

Health Reimbursement Arrangements (HRA): Changes for 2020

**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

Health Reimbursement Arrangements (HRAs), an employer-funded benefits option since the 1970s, will undergo an extensive transformation beginning in January 2020. In this blog, we’ll review how changes to the HRA environment could have significant implications for the group and individual health insurance markets and on employees’ health plan choices.

What is an HRA?

An HRA is a type of benefits arrangement in which employers reimburse employees for health insurance expenses like monthly premiums, deductibles, and out-of-pocket medical costs. Both sides of this agreement receive tax benefits, as businesses can claim a tax deduction for the reimbursements and employees are reimbursed for eligible expenses tax-free.

What’s the relationship between traditional group plans and HRAs?

Traditionally, most businesses that offer health benefits select one or several insurance plans in which employees may enroll. However, for those companies that want to sponsor health coverage for their employees without managing and administering the benefit themselves, HRAs represent an appealing alternative. Instead of employers shopping for plans, enrolling members and handling other health insurance-related tasks, most of these responsibilities would fall upon individual employees. HRAs permit each employee to make the best health insurance decisions for their specific requirements, while businesses simply provide reimbursements for qualified expenses. Most employers choose to offer either a group health plan or an HRA option– but not both.

Different Types of HRAs and what’s changing in 2020

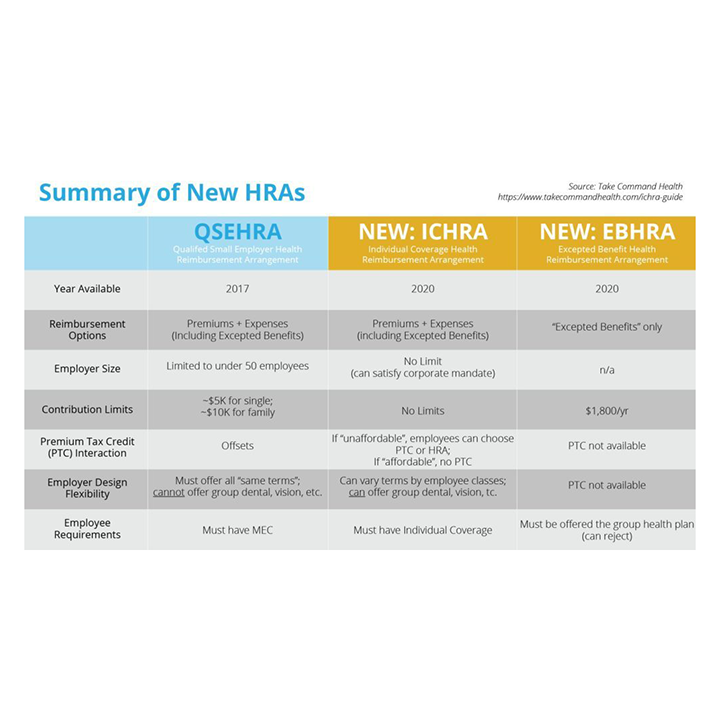

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA): Since 2017, small businesses — those with less than 50 employees — can offer HRAs that reimburse their employees for premiums and eligible healthcare expenses. These HRAs have contribution limits — $5,000 for an individual and $10,000 for a family — must offer all employee classes the same terms and cannot be used for ancillary benefits like dental, vision, etc.

Individual Coverage Health Reimbursement Arrangement (ICHRA): In June 2019, the Trump administration finalized new HRA rules that will create two new types of HRAs for 2020. ICHRA, like QSEHRA, will enable businesses to reimburse employees for premiums and other qualified expenses, but there are key differences between the two. ICHRA regulations include the following core features:

- businesses of any size will be eligible to offer ICHRAs.

- no restrictions on the annual amount employers may reimburse employees.

- businesses may offer varying terms, and reimbursement allotments, to different employee classes (such as full-time, part-time, seasonal, non-salaried, etc.).

- ICHRAs enable large employers to fulfill the Affordable Care Act’s employer mandate, which requires them to offer affordable, minimum essential health coverage to at least 95 percent of their full-time employees.

- ICHRA terms must remain uniform among employees of the same class, except that businesses may alter allotments based on the employee’s age or the number of dependents. ICHRA contributions, in order to satisfy the employer mandate, must provide employees an opportunity to purchase “affordable” individual market plans. According to the IRS, an ICHRA is considered affordable if “the remaining amount an employee has to pay for a self-only silver plan on the exchange is less than 9.86% of the employee’s household income.”

- ICHRA beneficiaries must maintain individual health coverage, through purchasing on-exchange or off-exchange insurance plans.

Excepted Benefit Health Reimbursement Arrangement (EBHRA): Also coming to the 2020 HRA environment are EBHRAs, another component of the recent Trump administration directive. EBHRAs allow employers to contribute up to $1,800 per year toward their employees’ expenses that are not covered by their group plan. These types of HRAs can be used to reimburse employees for expenses such as short-term insurance and dental, vision and home care, among other certified costs. Under EBHRA regulations, these employers must also offer a group health plan.

How will the new HRA landscape — particularly the arrival of ICHRA — impact employers and employees? What about HR platforms and InsurTech companies?

It’s expected that the new HRA rules, especially the availability of ICHRAs, will transform the employer-sponsored health insurance market by transitioning employees from group plans to the individual market. For employers, this lessens their administrative burden. For employees, this means more personal choice and greater control of their insurance options.

With more businesses eligible to offer HRAs, it’s likely the individual market will grow substantially over the next few years. And, millions of employees will experience shopping for and enrolling in on-exchange and off-exchange individual plans for the first time.

According to a U.S. Departments of Health and Human Services, Labor, and the Treasury estimate, it will take employers around five years to fully adjust to the updated rule, at which time roughly 800,000 businesses will offer ICHRAs. This, the departments’ modeling suggests, will cover about 11 million employees and family members.

The White House calculates that, as an effect of the new directive, the size of the individual market could increase by as much as 50%.

For HR and InsurTech platforms that currently support the group market, the individual market, or both, they must not only be prepared for this transition, but position themselves to thrive in this new environment. By supporting solutions for both plan types, InsurTechs can seamlessly migrate users from group plans to individual plans, therefore retaining customers who would otherwise be forced to shop elsewhere.

Interested in building digital solutions for the ICHRA market? Vericred recently published a digital toolkit, in which you’ll find resources on how ICHRA works, in-depth industry analysis, and use cases for creating solutions utilizing Vericred’s HRA Development Kit. If you are interested in learning more about Vericred, please contact us.