**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

Nearly 70% of Hospital Websites analyzed missed the mark.

A rule issued with much fanfare by the Department of Health and Human Services now requires that hospitals make their “chargemaster” public via the internet effective January 1st, 2019. The chargemaster is a list detailing the official rate or list prices charged by a hospital for individual procedures, services, and goods. There are no hospitals operating within the U.S. that are exempt under the new rule.

Much has been written about this new rule, with most experts correctly pointing out that very few people actually pay the chargemaster price because they have health insurance. Instead, health insurance carriers and hospitals negotiate, seeking to reach agreement on lower costs for procedures for each carrier’s members. In an ideal world, it would be the negotiated or contract reimbursement rates that would be made available online to patients. If a carrier does not reach agreement with any given hospital, then charges incurred by that carrier’s members at that hospital are treated as out-of-network and/or billed at the chargemaster rate.

With this policy in place, prospective patients are being encouraged to look to hospital websites to understand the cost of services. However, if patients with health insurance will ultimately pay less, then it would be reasonable to also look to those same websites to determine whether the hospital accepts the patient’s health insurance plan.

You would think so… however, the Vericred team investigated further and revealed surprising results.

We took a look at the websites for 29 hospitals in the Columbus, Ohio area to analyze the accuracy of the insurance information they posted. Specifically, we zeroed in on the section of their websites that outlined “insurance(s) accepted,” with a focus on Individual Under 65 (ACA or “Obamacare”) plans, available from the four health insurance carriers offering coverage on Healthcare.gov.

We compared our findings to each health insurance carrier’s consumer-facing provider directory as the “source of truth.”

The results were stunning:

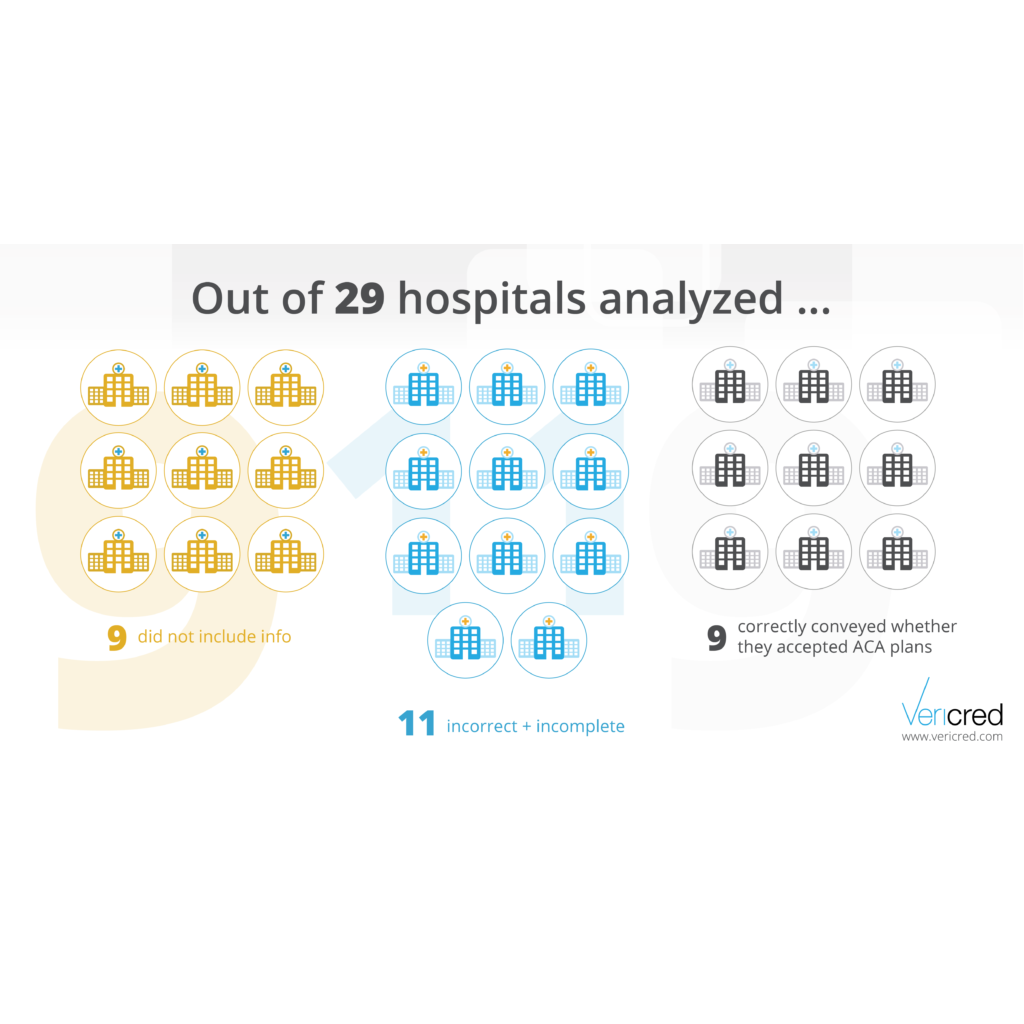

- Of the 29 hospitals analyzed, nine (31%) hospitals did not include information on which insurance they accept on their website.

- Of the remaining 20 hospitals, more than half provided incorrect information

- Only nine (or 45% of the hospital websites displaying such information) correctly conveyed whether or not they accepted one or more carrier’s ACA plans

Further, as a patient looking at these websites, there was a 9% chance that the hospital whose website they viewed actually accepted their plan, but showed otherwise — an avoidable false negative that could result in the patient going to different, less convenient, hospital.

Even more disconcerting, we found a 15% chance that the hospital will indicate that they take a plan when they do not — a false positive that has the potential to spiral into disastrous financial consequences to the patient. In this situation, the patient could select a hospital with the mistaken belief that their services will be covered by their insurance as in-network. Not only will that prove not to be the case, but the patient may well be billed at that chargemaster price which so few are.

The chargemaster ruling encourages us to look to hospital websites for the cost of services. But the true cost of service depends on whether or not the hospitals accept the patient’s insurance and if so, the negotiated rates. Hospital websites are not a reliable source for neither cost nor coverage. Patients will still need to call their insurance companies to determine this information.

Moral of the story: Until hospitals update their website information with complete, accurate and timely information, patient beware — take a good look at the chargemaster; you may end up paying those rates!