By Ideon co-founders Michael W. Levin and Dan Langevin

“What’s in a name?”

More often than not, quite a lot, especially when it comes to industry-leading technology companies.

We refer here to the API platform formerly known as Vericred, which has been powering digital experiences in health insurance and employee benefits since 2015 (give or take a few months).

Today we announced that we’re changing our name—to Ideon—because we believe it more accurately represents our core mission and the enormity of the problem we are solving, which is more important than ever. More crucially, the name change also more accurately reflects the work we do every day to help redefine member experiences in the health insurance and benefits industry.

You can read the official press release here, but we wanted to use this blog post to talk about our new moniker and fresh branding a bit less formally.

When we founded the company, together, a little more than seven years ago, we did so with the intention of rationalizing and simplifying the cumbersome process of verification for the credentials of medical professionals. Thus was born the name Vericred.

Almost immediately, however, our conversations with various industry constituents led us to identify an even bigger opportunity, which we recognized as far more important: enabling great member experiences through an efficient exchange of employee benefits data in a rapidly changing health insurance ecosystem.

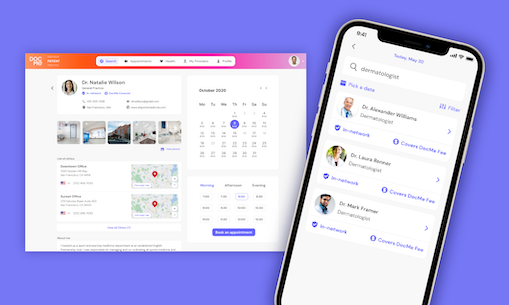

Even back in 2015, consumers were growing accustomed to managing all aspects of their lives on digital apps and platforms, and it was clear to us that they would increasingly expect similarly modernized benefits experiences. That is, they would want to compare, enroll in, and manage health insurance and voluntary benefits (e.g., dental, vision, life and disability insurance, legal services, investment advice, etc.) online. And they would want those experiences to be as easy as calling an Uber or booking a flight.

But seamless digital member journeys are only possible when data can flow freely and accurately between insurers and the HR and benefits platforms used by employers, employees, and brokers. So we began the hard work of building the benefits industry’s pipes, i.e., creating the APIs that now work behind the scenes to enable a faster and more efficient flow of data, empowering our partners and customers to build top-tier customer experiences.

Today, we are humbled to report, Ideon’s API platform is used by more than 300 carriers including MetLife, Principal, Beam, Kaiser and Guardian, and 100 HR and benefits platforms including Rippling, Gusto, Sequoia, and GoCo.

We are also humbled to report that we’ve been toying with an identity change for a couple of years, but good fortune got in the way. We’ve been growing so quickly that we struggled to find the time necessary to conduct a thoughtful naming process. In the past 12 months alone, following a $23 million Series B funding round, we’ve increased our headcount from 50 to more than 100 employees. We have likewise expanded our executive team, recruiting experienced leaders in product, engineering, customer success, marketing, and sales.

With that growth, we felt an even greater sense of urgency to ensure that our brand—the way our company is experienced before you are ever introduced to our platform—truly reflects the ease, security, and satisfaction which we have helped our customers deliver at every step of the benefits journey since day one. We’re proud of the organization we’ve become—and the ecosystem we’re powering—and we think our new name and brand accurately reflects this achievement.

Non-literal company names and brands can be their own kind of inkblot test, but to all of us here at Ideon (pronounced “eye-dee-ahn”) ours embodies first and foremost our role as ideator—and catalyst—for innovation in an industry that must continue to evolve. With everyone at Ideon focused intently on that goal, we know it will.

As for the second part of our new name, eons—that’s a geological term representing the largest time period. In our eyes, it’s a reference to the very real and sustainable impact we strive to make in this industry.

So, what’s in a name?

A promise to keep ideating transformative change and propelling modernized member experiences for all.