**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

This is the third of three posts on this subject

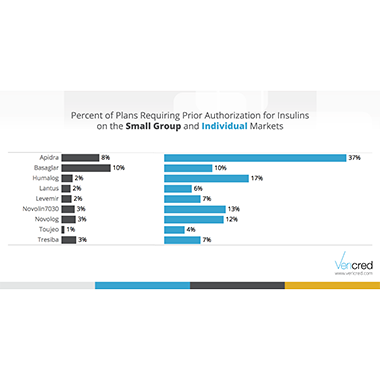

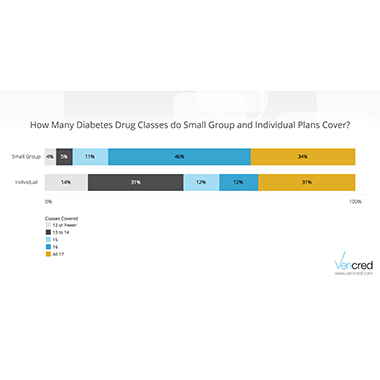

In this blog series for Diabetes Awareness month, we are exploring how the medications used to treat diabetes are covered by ACA health insurance plans. In our last two posts, we showed that many plans exclude entire classes of diabetes medication and explored the prevalence of prior authorization requirements for insulins. In this post, we will walk through a real-life example of how much drug coverage costs for a common diabetes medication.

Lantus is a popular, long-acting insulin used to control blood sugar in people with diabetes. The data science team at Vericred reviewed several silver plans on the 2019 individual market in the state of New York to see what the yearly cost of Lantus would be assuming one carton of Lantus injection pens per month; GoodRx estimates the cost for one carton to be $281.

An individual in New York covered by one of these silver plans will pay anywhere from $480 to $3,372 out-of-pocket for a year of Lantus. That’s up to seven times as much for the same medication. Real life is more complicated than this—most diabetes patients will see multiple doctors and fill a variety of prescriptions—but this simplified example illustrates the importance of carefully researching your health insurance options.

The out of pocket cost for Lantus depends on more than the premiums, deductibles, out of pocket maximums, and cost sharing for prescriptions. The widespread in the cost of Lantus is due to differences that may be harder to notice. Plan 1 does not apply the deductible to drug costs, meaning that from the first dollar the individual pays only the copay for Lantus. Plan 2 has a separate (and much lower) deductible specifically for drugs. Plan 3 requires the full deductible to be met before the copay applies. There are also differences in the plans’ formularies. Plans 1 and 3 cover Lantus as a preferred brand drug. Plan 2 covers Lantus as a non-preferred brand drug, meaning the cost sharing is higher than it would be for a preferred brand—in this case, a percentage of the drug’s cost rather than a flat copayment). The formulary for Plan 4 does not cover Lantus at all, meaning the plan will not pay for any portion of the drug’s cost. It is worth noting, however, that the total cost of healthcare (including premiums) for Plan 4 is actually the second lowest of the four example plans. Somewhat counterintuitively, a plan that does not cover the drugs you need might be less expensive, depending on the premium and other plan characteristics.

Formulary coverage and to which benefits the deductible does and does not apply are two easily overlooked aspects of health insurance design that shoppers need to be aware of when evaluating plans, but they need to be considered in combination premiums and other plan features to determine which will best meet your needs.