VeriStat: Silver Premiums on the Individual Market vs. the Small Group Market: Part II

Published on August 02, 2018

By: Ideon

**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

This is the second of three posts on this subject

The Affordable Care Act regulates both the individual and small group health insurance markets, yet these two markets are seldom looked at side by side. While many of the regulations governing plan design and premiums are the same, the markets serve very different populations and different health insurance carriers participate.

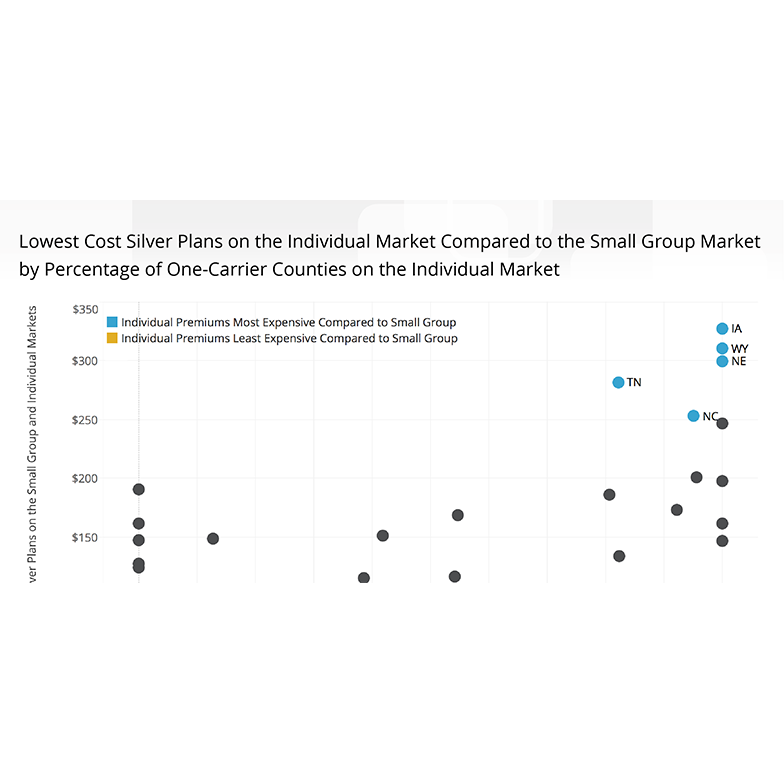

In our last post, we examined the difference in premiums for the lowest cost silver plans on the individual and small group markets. In this post, we will investigate how competition in the individual market is related to this premium difference.

The data science team at Vericred compared the difference in premiums for the lowest cost plans on the individual and small group markets to the percentage of “one-carrier counties”— counties with only one health insurance carrier offering on-market individual plans.* The results show a moderately strong relationship between lack of competition and increased premiums on the individual market. Of the five states where individual premiums are less expensive than small group, three have no one-carrier counties. The other two, Ohio and Indiana, have approximately half one-carrier counties but have heavy involvement of Medicaid Managed Care Organizations in the individual market, which tend to have somewhat lower premiums than other carrier types. All of the states where individual premiums are the most expensive compared to the small group have either mostly or exclusively one-carrier counties.

* Results are similar if the median cost silver plan is used instead of the lowest cost silver plan

This is the second of three posts; in the next post, we will investigate how the premium difference between the small group and individual markets has changed over time.