Ideon Blog

March 04, 2019

By: Ideon

VeriStat: Premium Change and Competition in the Individual ACA Market

**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

This is the sixth year in which individual health insurance plans have been offered under the Affordable Care Act. The early years of the market were characterized by significant fluctuations in carrier participation and premiums as players adjusted their strategies in response to the new environment. In this Veristat post, we examine the national trend in premiums from 2018 to 2019 in the individual market and the way in which county-level premium changes relate to carrier entry and exit.

The data science team at Vericred analyzed the lowest premiums available in each county for an individual plan sold on the federal or state exchanges in 2018 and 2019 for a 40-year-old nonsmoker. We excluded catastrophic plans, as they are only available to those under age 30 or with a hardship exemption.

The results show that the median US county saw a decrease of 2% (-$7) for its lowest cost plan. This stands in stark contrast to previous years, when premiums rose sharply. Also in contrast to prior years, this year saw ample carrier entry. There were 16 carrier entrances to new states and 34 instances of carriers expanding their service areas within a state. Conversely, no carrier left a state entirely, and there were only 7 instances of existing carriers contracting their service areas within a state. As a result, almost one in four counties had more carriers providing plans in 2019 compared with 2018 and only 1% had fewer carrier options.

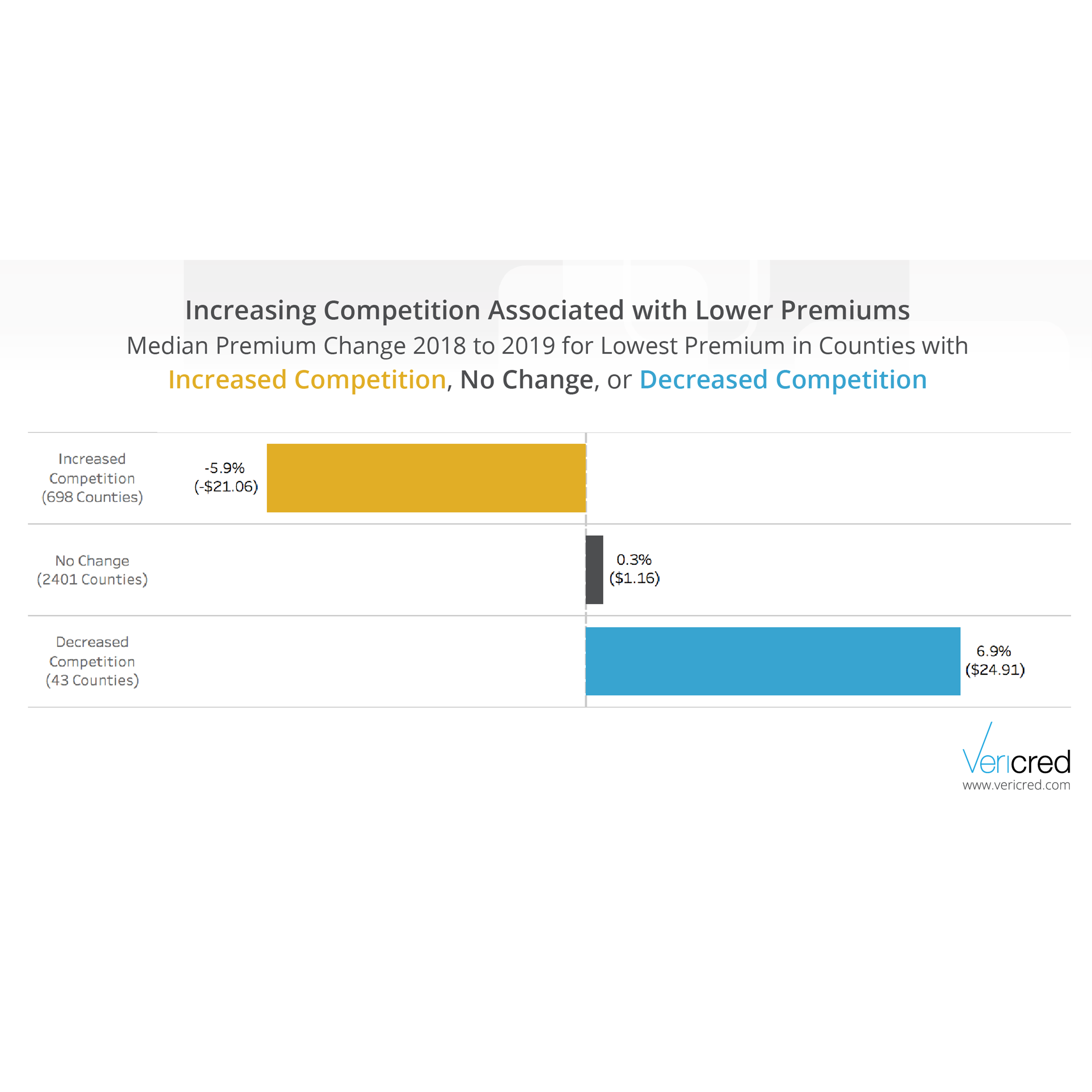

On balance, the counties with increased competition showed decreased premiums. The median county with more carriers in 2019 than 2018 had a 6% ($21) decrease in its lowest premium. Conversely, the much smaller number of counties with decreased competition tended to show increased premiums. The median county with fewer carriers had a 7% ($25) increase in its lowest premium. The counties with no change in competition showed very little change in premiums. The median county with the same number of carriers in 2018 and 2019 had less than a 1% increase ($1) in its lowest premium.

The individual ACA market appears to have stabilized in 2019, particularly in contrast to the carrier exits and large premium increases seen in previous years. This year saw substantially more carrier entry than exit, and premiums generally remained similar to their 2018 levels. Almost a quarter of counties had more competition in 2019 that 2018, and these counties tended to see decreased premiums. It remains to be seen if this stability will continue into 2020 as the market continues to react to changes in the ACA landscape including the zeroing of the individual mandate and the increased availability of short-term health insurance plans.