VeriStat: How Transitioning to Individual Coverage HRAs Could Impact Employees’ Premiums

Published on September 19, 2019

By: Ideon

**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

New to Health Reimbursement Arrangements (HRA)? Check out our recent blog to better understand HRA basics and learn what’s changing in 2020.

Health Reimbursement Arrangements (HRA) will undergo significant changes beginning in January 2020, a transformation that could potentially shift millions of employees from traditional group health plans to the individual ACA market. In this VeriStat, we’ll explore how transitioning to Individual Coverage HRAs (ICHRA) — available for the first time next year — could alter employees’ health insurance options. We’ll also analyze, at the county and state levels, how monthly premiums on the individual market compare with small group premiums.

In June 2019, the Trump administration finalized new HRA rules that will create a new form of HRAs for 2020: ICHRA. Similar to previous types of HRAs, ICHRAs will enable businesses to reimburse employees for premiums and other qualified expenses, but there are also key differences. ICHRA regulations include the following core features:

- Businesses of any size will be eligible to offer ICHRAs.

- No restrictions on the annual amount employers may reimburse employees.

- Businesses may offer varying terms, and reimbursement allotments, to different employee classes (such as full-time, part-time, seasonal, etc.).

- ICHRAs enable large employers to fulfill the Affordable Care Act’s employer mandate, which requires them to offer affordable, minimum essential health coverage to at least 95 percent of their full-time employees.

- ICHRA beneficiaries must maintain individual health coverage, through purchasing on-exchange or off-exchange insurance plans.

Individual Market Premiums vs. Small Group Premiums

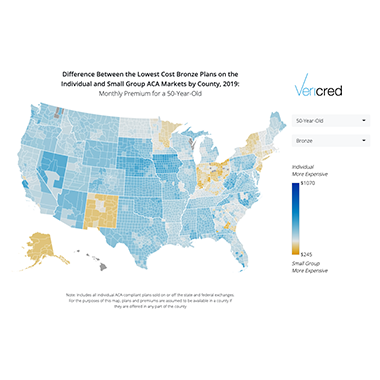

For businesses considering a move to ICHRAs, it is essential to determine whether their employees will have access to affordable health plans on the individual market. The below interactive map details, at the county level, the difference in monthly premiums between the lowest-cost plans on the individual and small group markets. This map — which displays premiums for a 50-year-old or a 27-year-old across bronze, silver or gold metal tiers — reveals the regions where individual ACA plans are competitively priced compared to small group plans. Such regions are likely more suitable for ICHRA adoption than those where employees would, in most cases, face significantly higher premiums on the individual market.

The lowest-priced bronze plan is more expensive on the individual market, compared with the small group market, in 84 percent of counties. In 60 percent of U.S. counties, a 50-year-old’s premium for the lowest-priced bronze plan would be at least $100 more on the individual market than on the small group market. This forms a potential hurdle that, in certain regions, might limit the number of companies that adopt ICHRAs.

The following are the only states where the individual market is less expensive compared to small group. These are states where, potentially, employees could benefit from joining the individual market vs. their current small group coverage.

- Alaska

- New Mexico

- Ohio

- Rhode Island

- Indiana

- New Jersey

- New York

- Connecticut

- Minnesota

*Ranked by the median county’s difference between individual and small group bronze-plan premiums for a 50-year-old

And the following states, in particular, are where the individual market is most expensive compared with the small group market.

- Iowa

- Nevada

- Nebraska

- Oklahoma

- West Virginia

- Kansas

- Arizona

- South Dakota

- Missouri

- Alabama

*Ranked by the median county’s difference between individual and small group bronze-plan premiums for a 50-year-old

Cost differences between the individual and small group markets, however, are far from the only factor businesses must weigh in evaluating whether an ICHRA is right for them and their employees. ICHRAs provide employees with plan transportability and greater choice — advantages that are absent among traditional group plans — and should be primary considerations for employers, as well.

Interested in building digital solutions for the ICHRA market? Vericred recently published a digital toolkit, in which you’ll find resources on how ICHRA works, in-depth industry analysis, and use cases for creating solutions utilizing Vericred’s HRA Development Kit. If you are interested in learning more about Vericred, please contact us.