Ideon Blog

June 19, 2018

By: Ideon

VeriStat: How Deductibles for Silver Plans Vary by State: Part II

**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

This is the second of three posts on this subject

To increase transparency, plans offered under the ACA are given metal levels based on how the cost of care is split between an individual and their health plan. Silver plans must cover 70% of a typical population’s healthcare costs, but plans can use a wide variety of different cost-sharing structures to arrive at this 70%. The deductible—the amount the individual must cover before their plan begins to pay—is one factor that can make a big difference to out-of-pocket costs.

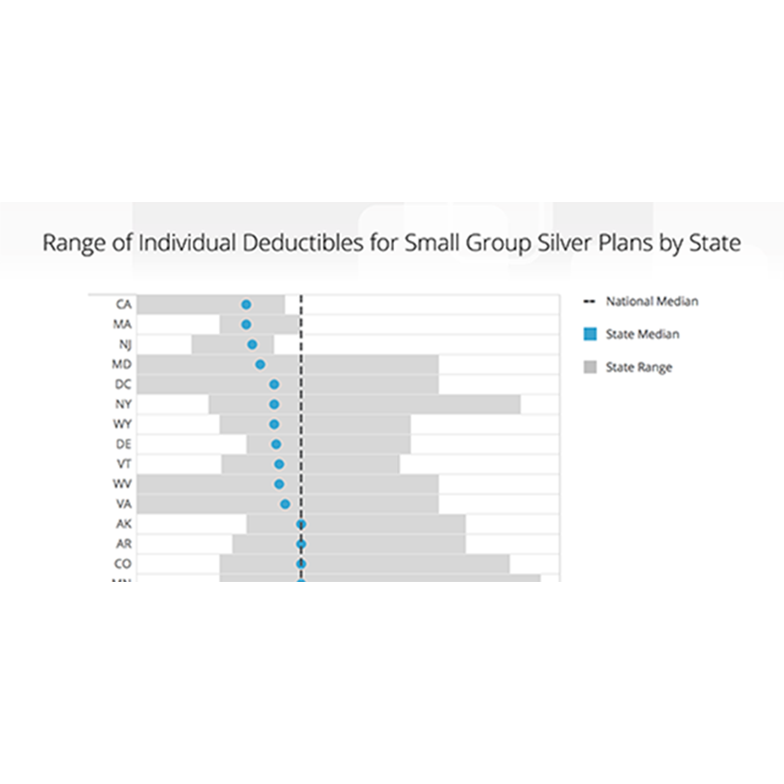

In our last post, we examined the median deductible for small group silver plans by state and found that there is substantial geographic variation by state. In this post, we will explore the variation in deductibles within states.

The data science team at Vericred investigated the range of deductibles for small group silver plans within each state. The results show that every state has silver plans with a wide range of deductibles. Employers shopping for a small group plan should consider which aspects of cost-sharing matter most to their employees, as plans with the same metal level in the same market can vary widely in their cost-sharing.