By Jashan Ahuja

Group Product Manager – Enrollment

In Part 1 of our error management blog series, we explored Ideon’s ability to process errors in a centralized and consistent way. Now, in Part 2, we delve into our industry-leading auto-reconciliation feature, which proactively identifies discrepancies between platform and carrier systems.

It’s a scenario all too common in the group benefits industry: a benefits administration (BenAdmin) platform sends enrollment data to a carrier via an EDI file and waits a week or more — with no visibility into whether the information was accepted — only to receive back an unreadable report of errors and discrepancies.

Now imagine a world with lightning-fast data exchange, two-way communication, and seamless reconciliation between platforms and carriers. The platform would receive a notification within minutes that lists all discrepancies between the two systems.

Ideon’s automatic reconciliation system makes the above not only possible, but easy to implement and scalable across carriers. It’s an industry-first feature that offers the capability of proactive data reconciliation between the platform and carrier systems.

In our prior blog, we explored Ideon’s ability to standardize and expose errors generated by carrier systems, transforming them into a consistent, human-readable, and actionable format. That crucial feature forms the foundation for closing the feedback loop with carriers. But Ideon doesn’t stop there. In this blog, we examine auto-reconciliation, a revolutionary process that identifies and surfaces discrepancies in near real-time, even before the data has been sent to the carrier.

What is auto-reconciliation?

Auto-reconciliation is an essential component of Ideon’s data exchange process, significantly streamlining the enrollment workflow for carriers and benefits platforms alike. This innovative process flags discrepancies before data reaches the carrier’s system, dramatically reducing downstream errors that could otherwise wreak havoc on carrier operations—and members.

Here’s how it works: Ideon’s reconciliation engine proactively pulls all member and coverage information for a group from the carrier, converts it to our data model, and compares it to the platform data on a field-by-field basis.

The comparison encompasses 18 data points, also known as “discrepancy parameters,” including demographic data (e.g., birth date, SSN), coverage details (e.g., plan start date, plan volume), or even the existence of a member or their coverage in one system but not the other. We’re able to specify the source of any discrepancies for our partners and provide both platform and carrier values, creating a clear, actionable pathway to resolution.

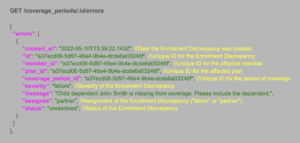

Consider the example below, where a carrier’s system contains a different birth date compared to the one entered on the benefits platform. Without validation, this discrepancy would inevitably lead to errors for this subscriber. However, by matching the carrier’s existing information with the enrollment record, Ideon can promptly detect the discrepancy and return the record to the platform for correction.

"errors": [

{

"id": "a37ecd06-5d97-46e4-9b4e-dcde6a03246f",

"member_id": "a37ecd06-5d97-46e4-9b4e-dcde6a03246f",

"plan_id": "a37ecd06-5d97-46e4-9b4e-dcde6a03246f",

"coverage_period_id": "a37ecd06-5d97-46e4-9b4e-dcde6a03246f",

"discrepancy": {

"parameter": "birth date",

"carrier": "1/1/93",

"platform": "2/1/93"

}

]

During our processing, we reconcile 18 different critical fields, as well as verify the presence of the member in the carrier’s database.

| Annual earnings

Birth date Coverage Dependent Employment end date Employment start date Employment status Gender Marital status |

Plan ID Plan end date Plan start date Plan volume Primary care provider Residential address Social security number Subscriber Wage frequency |

Additional features

Ideon’s auto-reconciliation system boasts several features for fast, accurate data exchange, smooth operations, and an enhanced member experience.

Deduplication

Automatic reconciliation operates daily, comparing new discrepancies against open ones from the previous run and resolving any that are no longer relevant. This keeps carrier and platform systems in sync with current data and ensures the list of open discrepancies is directly relevant.

Frequency + Timing

Automatic Reconciliation runs as frequently as daily for carriers supporting an API-based, automatic census retrieval. Resolved discrepancies are closed every morning, while newly identified ones are opened.

We are currently expanding our auto-reconciliation functionality with carrier partners that don’t yet support a daily census.

As part of our reconciliation process, we carefully consider the timing of data in and out of our system. When our system receives a data element that hasn’t been sent to the carrier yet, our reconciliation logic takes this into account by comparing the carrier’s data with the previous version of that data field. Once the field is transmitted to the carrier, it is incorporated into the next reconciliation cycle, with a buffer for carrier processing time. This thoughtful approach prevents noise, such as unwarranted and erroneous discrepancies.

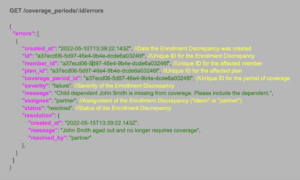

Surfacing Discrepancies

All actionable enrollment discrepancies—originating from either auto-reconciliation or carrier error reports—are returned in a consistent, normalized format. Partners can access this information through:

-

-

- direct GET requests via our API endpoints

- proactive push notifications using webhooks, or

- our standardized Enrollment Discrepancies CSV, delivered periodically

-

By centralizing Enrollment Discrepancies, we enable a more efficient and streamlined operational process, allowing benefits platforms to view errors generated by carriers and the results of auto-reconciliation all in one place.

Impact

Leveraging our unique, central position between platform and carrier systems, we have quantified the volume of out-of-sync data. After analyzing data from hundreds of groups and thousands of members, we found that about 8% of employee enrollments have a critical coverage issue, i.e. incorrect coverage dates, plan information, or birth date, or they’re missing entirely from either the carrier or platform system. For one specific platform-carrier combination, we saw 10.3% of subscribers with at least one error that affects enrollment accuracy. Additionally, 80% of groups with more than 20 subscribers had one or more critical errors.

Overall, proactively identifying coverage-affecting errors is critical for reducing inaccurate enrollments and downstream issues. Automatic reconciliation allows groups to detect and resolve discrepancies before the initial transmission to the carrier. This improves success rates for the initial transition of groups into production and allows for faster, more accurate group setups, ultimately resulting in a better member experience.

Coming soon – Part 3: Account structure consolidation and mapping

Enrolling members in the correct plans with the correct carriers all starts with precise, streamlined setup processes. In the next blog in this series, we’ll detail how Ideon enhances a platform’s mapping capabilities, making it easier to configure complex group setups when employers have multiple plans, classes, and divisions.