Vericred Analytics: Rate Favorable States for Small Groups to Shift to ICHRAs

Published on January 19, 2021

By: Ideon

**Ideon is the company formerly known as Vericred. Vericred began operating as Ideon on May 18, 2022.**

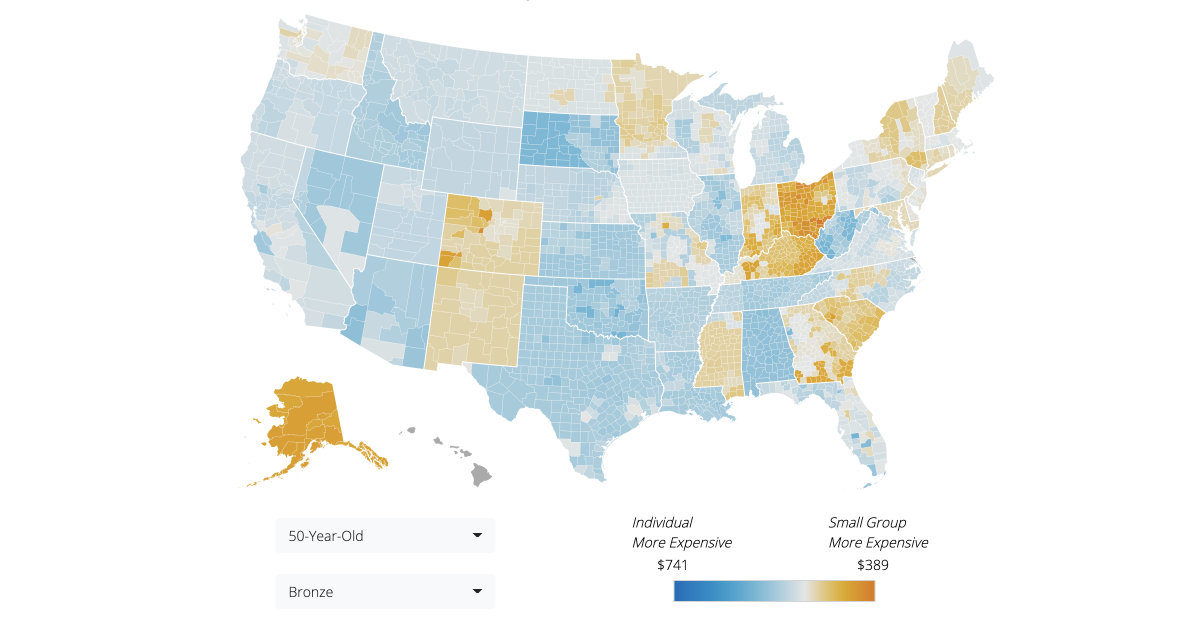

ICHRAs are the hottest topic in employer-sponsored healthcare. We at Vericred are tracking a number of plan attributes that could accelerate or retard this shift from small group coverage to the individual market. Here, we look at one of them: premium changes between 2020 and 2021.

In 2021, there are five new states (Maryland, Maine, Mississippi, New Hampshire and Washington) where individual plan premiums are equal to or less expensive than small group premiums. Interestingly, increased competition was not the driver of these lower individual premiums: only one of the states, Maryland, welcomed a new carrier to its individual market. (Note: Two states—New Jersey and North Dakota—saw small group premiums become less expensive than individual plan premiums.)

In aggregate, the average (across all of a state’s counties) lowest-cost Bronze individual plan premium was equal to or lower than the small group equivalent in 19 states; that’s up from 16 in 2020 and 11 in 2019. The average lowest-cost Silver individual plan premium was equal to or lower than the small group equivalent in 13 states, up from 11 in 2020 and six in 2019. And, the average lowest-cost Gold individual plan premium was equal to or lower than the small group equivalent in 12 states, up from seven in 2020 and five in 2019. Overall, the number of ICHRA premium-friendly states has roughly doubled over the past two years.

More broadly, the disparity between small group and individual rates has attenuated over the same period. In 2021, the average Bronze plan premium differential between individual and small group markets across all states is down to just 10%, from 15% in 2020 and 25% in 2019. Similarly, the average Silver plan premium differential is down to 23%, from 28% in 2020 and 42% in 2019. And, the average Gold plan premium differential is down to 25%, from 32% in 2020 and 45% in 2019.

Since the launch of the ACA, much has been made about the annual rate increases, particularly in the individual market. More recently, though, the opposite appears to be the case. From 2019 to 2021, state-average individual plan premiums actually went down in real dollar terms in two thirds (67%) of the country. Small group rates, on the other hand, fell in only 12-20% of the states, depending on metal level. The data has spoken: Individual rates are falling.